Item model groups (form) [AX 2012]

Click Inventory management > Setup > Inventory >

Item model groups.

Use this form to create and maintain item model groups.

These groups contain settings that determine how items are controlled and

handled on item receipts and issues. The settings also determine how the

consumption of an item or items is calculated. A single model group can be

associated with many items. Therefore, maintenance is easier, because you can

control many items by using the same setup.

NoteNote

When you set up and assign item model groups to products, be

aware of the restrictions that may apply if you change the setup. If a product

has open transactions, you might receive a warning and be unable to complete

the following tasks:

A descriptive name for the item model group.

Stocked product:

Select this check box to indicate that the product should be

handled in inventory. Products that are handled in inventory generate inventory

transactions. These products can be included in cost calculations. On-hand

quantities can also be maintained for these products.

NoteNote

Stocked products include items and services. A service

cannot be added to stock. However, Microsoft Dynamics AX requires that pro

forma stock transactions be generated for services that contribute to the

inventory value of tangible goods. For example, pro forma stock transactions

must be generated if a service is used to subcontract production steps.

Physical negative

inventory

Select this check box to enable negative physical inventory

for the item model group.

NoteNote

Microsoft Dynamics AX does not verify that items are

physically in inventory when items are picked.

Example

Production is started, but not all items for the production

are in inventory. The items have been ordered, and delivery has been scheduled.

Alternatively, an order for an item is updated. Even though the item is not in

inventory, it has been purchased and will soon be in inventory.

Financial negative

inventory

Select this check box to enable negative financial inventory

for the item model group.

Negative financial inventory is often used for services. If

the check box is cleared, the cost price must be known for the quantity that is

financially pulled from inventory.

Example

Eight items are invoice-updated, and five other items are

packing slip–updated. Therefore, the physical on-hand inventory is 13. If this

check box is cleared, negative financial inventory is not enabled. Therefore,

only eight items are available when a sales order is invoice-updated, even

though 13 items are available in on-hand inventory.

Quarantine

management

Select this check box to indicate that items that are

associated with the item model group are subject to the rules and requirements

for quarantine management.

This check box is used for items that are set aside and

awaiting approval for distribution.

If the check box is cleared, items are not under quarantine

management, unless a quarantine order is created manually in the Quarantine

orders form.

When the item is registered, a quarantine order is

generated. This quarantine order has a status of Started.

Consolidated

picking method

Select this check box to pick multiple orders, and to use

picking areas and shipment functionality.

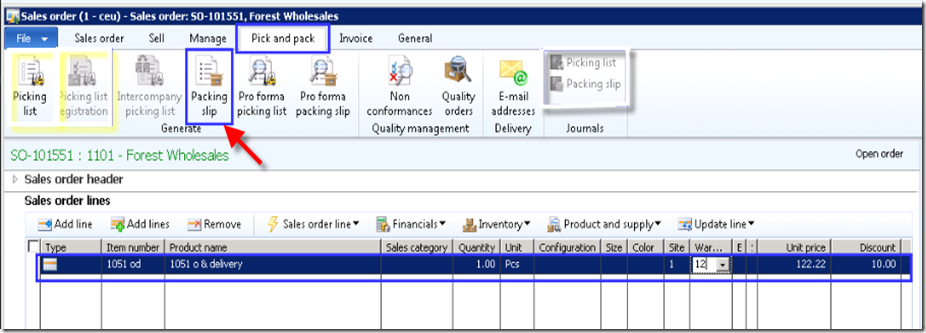

Post physical

inventory

Select this check box to post physical item transactions in

the ledger.

The physical item transactions are posted as follows:

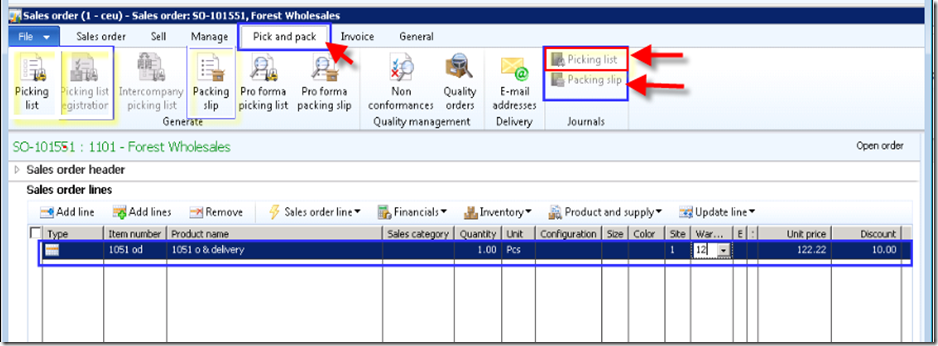

Packing slips and product receipts are posted if the Post

product receipt in ledger check box is selected in the Accounts payable

parameters form, or if the Post packing slip in ledger check box is selected in

the Accounts receivable parameters form.

Production orders that are reported as finished are posted

if the Post report as finished in ledger check box is selected in the Production

control parameters form.

If the check box is cleared, packing slips, product

receipts, and production orders that are reported as finished are not posted in

the ledger, regardless of the settings in the parameter setup forms.

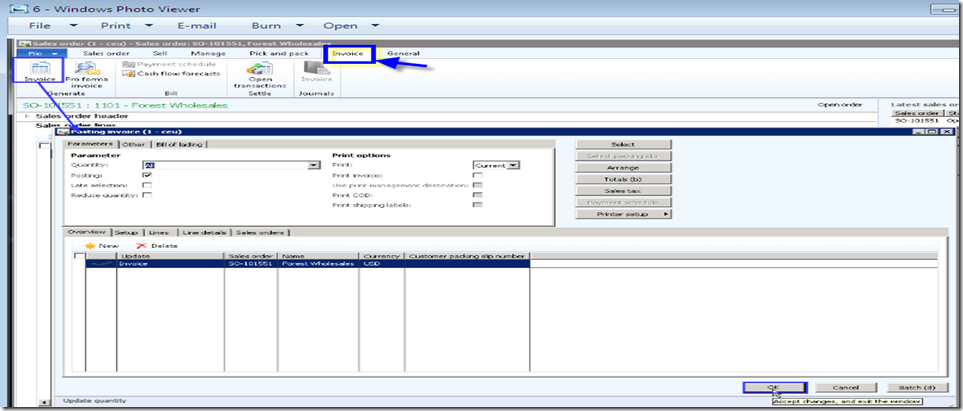

Post financial

inventory

Select this check box to post the updated financial value of

items in the ledger.

When a purchase order is invoice-updated, the value of the

items is posted to the inventory receipt account. When a sales order is

invoice-updated, the value of the items is posted to the inventory issue and

the consumption accounts. The inventory value that is posted can then be

reconciled with the related status accounts in General ledger.

If the check box is cleared, when a purchase order is

invoice-updated, the value of the items is posted to the item consumption

account, but not to the inventory receipt account. When a sales order is

invoice-updated, no posting occurs in the item consumption account or the issue

account.

NoteNote

Clear this check box for service items if the item

consumption should not be posted when sales orders are invoiced.

When the check box is cleared, the journal lines for the

items do not generate ledger postings.

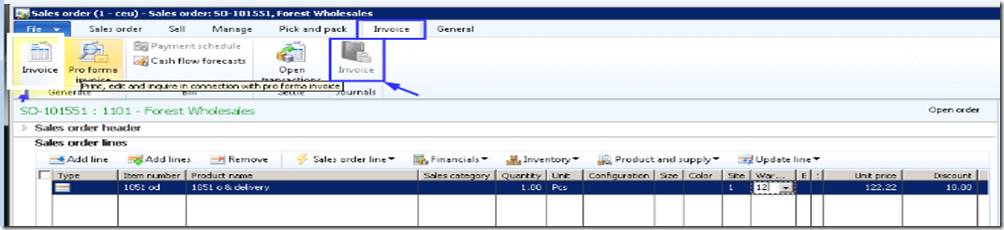

Post to Deferred

Revenue Account on Sales Delivery

Select this check box to accrue the estimated revenue for

the delivered quantity of packing slip updates. The accrued revenue that is

accounted on the sales delivery is offset when the customer is invoiced for the

delivery.

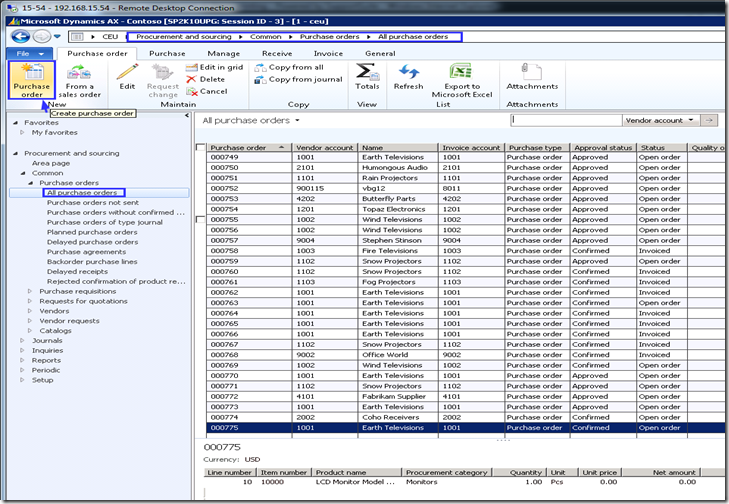

Accrue liability

on product receipt

Select this check box to accrue the estimated expense for

packing slip updates to the general ledger.

Registration

requirements

Select this check box to indicate that item receipts must be

registered before inventory is physically updated.

The status of the inventory transaction for the item receipt

must be Registered before the item's product receipt is updated.

This field is used by warehouse management. Registered items

are part of physical inventory. You can register items in the warehouse

management journals. Alternatively, you can click Inventory, and then click

Registration on the relevant journals and orders.

Receiving

requirements

Select this check box to indicate that item receipts must be

physically updated before they can be financially updated.

NoteNote

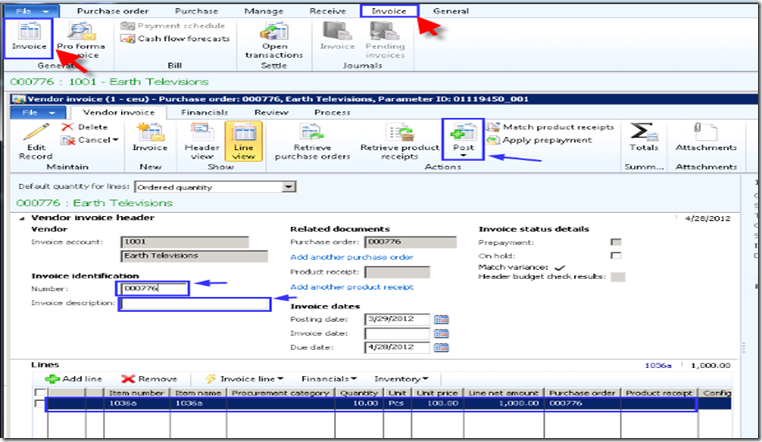

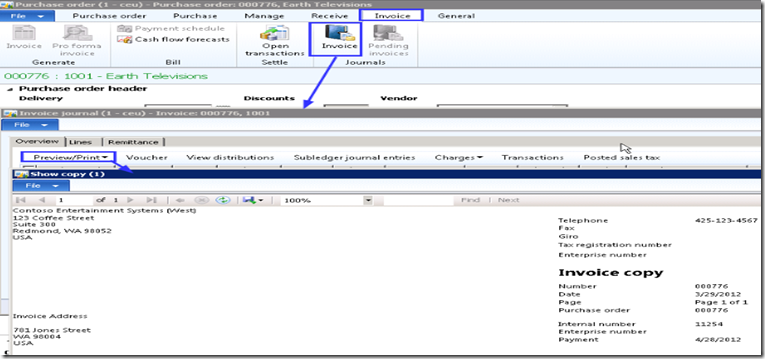

If you post a vendor invoice, a product receipt must be

entered and posted before the vendor invoice for the product receipt can be

posted. The received quantity on the product receipt might differ from the

invoiced quantity. In this case, an icon is displayed in the Product receipt

quantity match field in the Vendor invoice form. For more information, see

Vendor invoice (form) and Set up Accounts payable invoice matching.

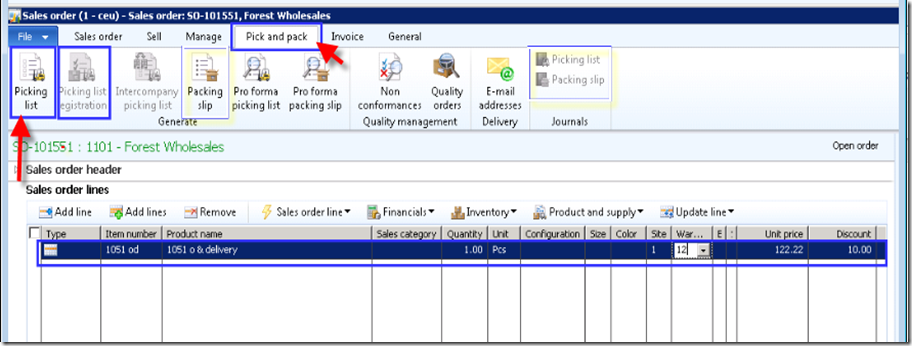

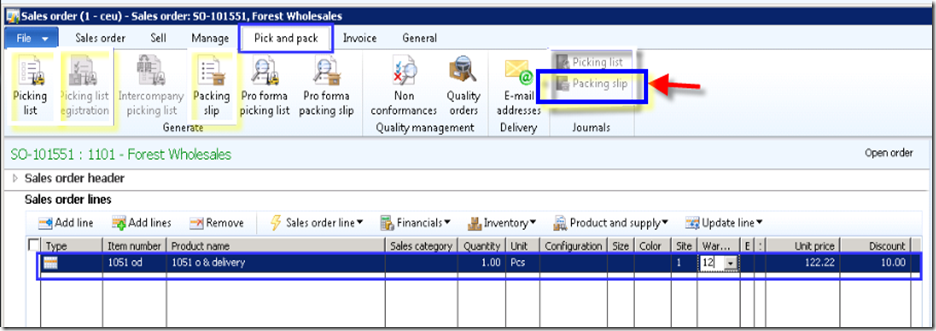

Picking

requirements

Select this check box to indicate that item issues must be

picked before inventory is physically updated.

The status of the inventory transactions for the item issue

must be Picked before the packing slip is updated.

This field is used by warehouse management. Picked items are

part of physical inventory. Items can be picked in the warehouse management

system by dispatches and picking routes. Alternatively, you can click

Inventory, and then click Registration on the relevant journals and orders.

NoteNote

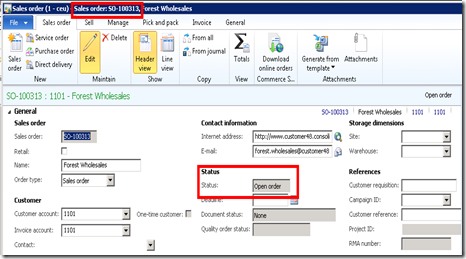

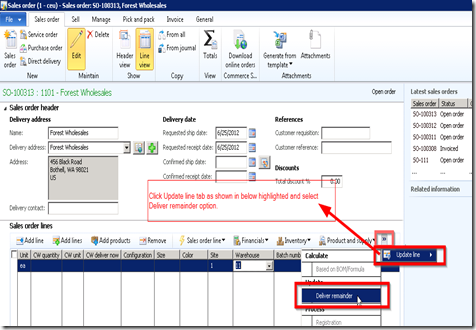

If you create a direct delivery from a sales order, the

Picking requirements parameter is ignored, because items are transferred

directly from the vendor to the customer. These items do not physically come

into your company.

Deduction

requirements

Select this check box to indicate that item deductions must

be physically updated before they can be financially updated.

NoteNote

If you post a vendor invoice, a product receipt must be

entered and posted before the vendor invoice for the product receipt can be

posted. The deducted quantity on the product receipt might differ from the

negative invoiced quantity. In this case, an icon is displayed in the Product

receipt quantity match field in the Vendor invoice form. For more information,

see Vendor invoice (form) and Set up Accounts payable invoice matching.

Backward from ship

date

Select this check box to reserve expected receipts, such as

open purchase order lines, that have a date of receipt that is nearest to the

delivery date of the sales order. If the check box is cleared, incoming

inventory transactions that have the earliest date of receipt are reserved.

NoteNote

Items that are available in inventory are not controlled by

the Backward from ship date parameter. To control the available inventory that

is reserved, you can use dimensions, such as corresponding batch numbers.

Alternatively, you can mark orders. For more information about how to mark

orders, see Mark orders.

Inventory model

Select the inventory model that is used to close and perform

adjustments in the Closing and adjustment form.

Include physical

value

Select this check box to indicate that transactions that are

physically updated should be included in the calculation of the average cost.

At inventory close, this parameter may be used, depending on

the method that is used for inventory valuation.

The following inventory valuation methods use this parameter

during inventory close:

FIFO

LIFO

LIFO date

The following inventory valuation methods do not use this

parameter during inventory close:

Weighted avg.

Weighted avg. date

Fixed receipt

price

Select this check box to adjust issues and receipts to a

fixed receipt price.

The fixed receipt price is a principle for inventory

valuation that sets the price of receipts to the active planned cost or basic

cost of a product.

TipTip

The fixed receipt price is defined in the Price field on the

Manage costs tab in the Released product details form.

When the check box is selected, receipts and issues are

posted as follows:

Purchase receipts – Posting occurs at the actual cost.

Purchase invoices – The price difference between the actual

cost and the fixed receipt price is posted to the general ledger as a variance.

The amount is posted to the loss or profit account for the fixed receipt price.

Inventory is updated based on the fixed receipt price.

Sales order packing slips and sales invoices – Posting

occurs at the estimated cost.

When you run an inventory close or a recalculation, if this

check box is selected, the value of issue transactions is adjusted according to

the price that is specified in the Price field. If this check box is cleared,

the value of issue transactions is not adjusted according to this price.

NoteNote

If the fixed receipt price is changed, and you want all new

issue transactions to use the new cost, follow these steps:

Run an inventory close.

Adjust the balance for the on-hand inventory, so that the

balance matches the new cost.

Activate a new planned cost.