Once you have setup Charges Codes, you can add manual charges to Sales Order (SO) or Purchase Order (PO). The question is why do we need to add charges manually to orders if we have the auto charges functionality? Typically we add manual charges to an order if it is not a regular one, which needs some eccentric charges to be addressed. An example could be expedited orders which need to be shipped before standard delivery times. In this case we may need to charge additional amount for freight. This is where Manual Charges come to play their role.

Manual Charges for Sales Order:

Manual charges can be added to either the SO header, individual line items or both the header and the line items. To setup the manual charges to:

1. SO header, navigate to Sell tab → Charges to open Charges Transactions Form.

2. SO lines, navigate to Financials → Maintain Charges to open Charges Transactions Form.

2. SO lines, navigate to Financials → Maintain Charges to open Charges Transactions Form.

The fields of Charges Transactions form are described below:

| Field | Description |

| Charges codes | Select Charge code. For more details read the full post Charges Codes |

| Transaction text | Text defined in the description of the charge code |

| Category | Describes how the charges are calculated:

|

| Charges value | Enter the amount for this charge. It can anyone of the following depending on the category selected:

|

| Currency | Defaulted from the currency of the selected charge code |

| Keep | Indicates whether the charges transactions must be retained after partial invoicing or not |

Manual Charges for Purchase Order:

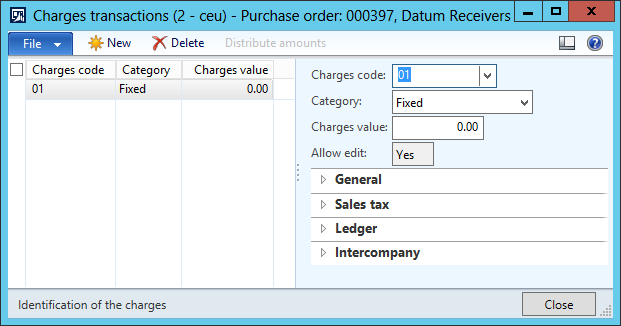

Similarly, we can add charges manually to PO header or PO lines or both depending on the scenario. To setup the manual charges to:

1. PO header, navigate to Purchase tab → Manage Charges to open Charges Transactions Form.

2. PO lines, navigate to Financials → Maintain Charges to open Charges Transactions Form.

2. PO lines, navigate to Financials → Maintain Charges to open Charges Transactions Form.

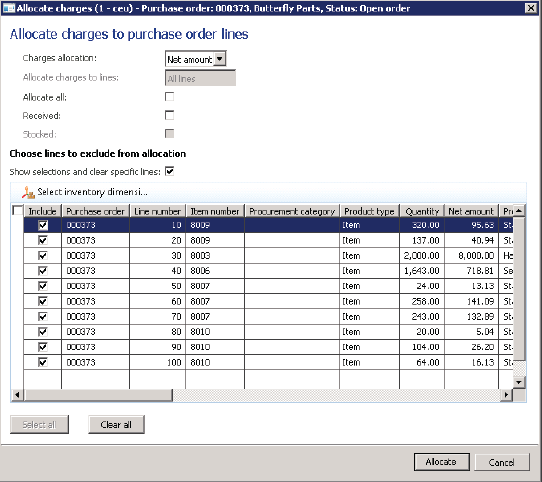

You can see the description of Charges Transactions Form above. In Purchase Order, we can also allocate header charges to lines. We determine how this allocations should be carried out by navigating to Purchase tab → Charges → Allocate charges.

The fields of Allocate Charges form are described below:

| Field | Description |

| Charges allocation | If the header charge is fixed in nature then it can be divided using the following options:

|

| Allocate charges to lines | Choose lines for allocation:

|

| Allocate all | Select if you want to include all kinds of charges in the allocation process regardless of the Debit type specified in the Charges code setup. By default, charges with Debit type of Item are included in the allocation process |

| Received | Select to only allocate charges to received order lines |

| Stocked | Select to only allocate charges to inventoried order lines |

| Show selection and clear specific lines | Select to exclude specific lines from this allocation. This check box is not available if no charges are set up |

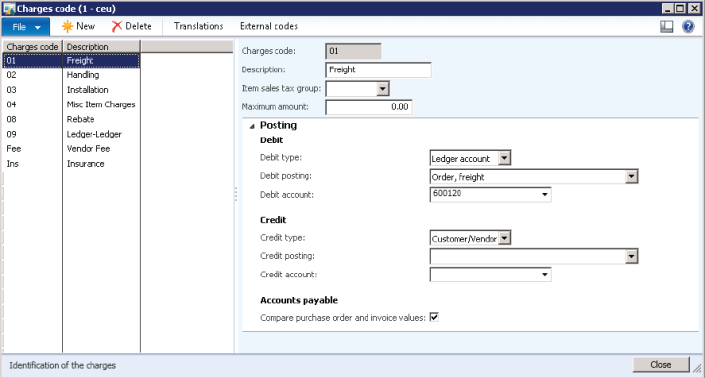

AX 2012: Charges Codes

Before you plan to add manual or automatic charges when you create a sales or purchase order, you must setup Charges Codes. They are used to define the kind of charge and how the charge is going to be debited or credited. You can setup charges by navigating to Setup → Charges → Charges codes in the following 3 modules:

1. Accounts Receivable

2. Accounts Payable

3. Procurement and Sourcing

2. Accounts Payable

3. Procurement and Sourcing

Fields on the Charges codes form are described below:

1. Charges code: Unique code for the charge

2. Description: Brief description about the charge

3. Item sales tax group: An item sales tax group that can be used for calculating taxes on the charge

4. Maximum amount: Maximum amount allowed for the charge

2. Description: Brief description about the charge

3. Item sales tax group: An item sales tax group that can be used for calculating taxes on the charge

4. Maximum amount: Maximum amount allowed for the charge

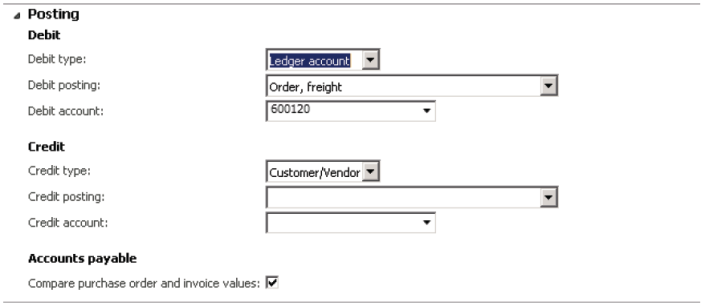

Posting Fast Tab

This is where the actual game happens. In this posting fastTab we define how to automatically debit and credit the charge. Both debit and credit sections have the following fields:

1. Type – Defines the entity which will be billed for the charge. Following are the available options:

- Item – Charge is added to the item cost

- Ledger Account – Charge is billed internally to the ledger account

- Customer/Vendor – Charge is billed to the customer/vendor

2. Posting – Free text field to give the description which will be used while posting the charge to journals

3. Account – Defines the ledger account which must be debited/credited when Type is set to Ledger Account

So far we have understood what is the purpose of different parameters used to configure charges codes. Let us now create charges codes for sales and purchases. In both cases the parameters discussed will be set differently to cater to different needs of sales and purchases.

Charges Codes for Sales

For sales, you can configure charges in 2 different ways:

1. Customer

Charge is billed to the customer and is added to the sales order totals. Follow the steps below to achieve this functionality:

1. Open Accounts receivable > Setup > Charges > Charges code.

2. Click New to add a new code.

3. In the Charges code field, type a unique identifier for this charge.

4. In the Description field, type a short description of the charge.

5. Click the Item sales tax group arrow and select the sales tax group.

6. Click the Posting tab.

7. Setup the debit/credit fields as follows:

2. Click New to add a new code.

3. In the Charges code field, type a unique identifier for this charge.

4. In the Description field, type a short description of the charge.

5. Click the Item sales tax group arrow and select the sales tax group.

6. Click the Posting tab.

7. Setup the debit/credit fields as follows:

| Debit | Type | Customer/Vender |

| Posting | N/A | |

| Account | N/A | |

| Credit | Type | Ledger Account |

| Posting | Specify | |

| Account | Specify |

2. Ledger Account (Internal)

Charge is billed to an internal ledger account and does not show up on sales transactions. Follow the steps below to achieve this functionality:

1. Open Accounts receivable > Setup > Charges > Charges code.

2. Click New to add a new code.

3. In the Charges code field, type a unique identifier for this charge.

4. In the Description field, type a short description of the charge.

5. Click the Item sales tax group arrow and select the sales tax group.

6. Click the Posting tab.

7. Setup the debit/credit fields as follows:

2. Click New to add a new code.

3. In the Charges code field, type a unique identifier for this charge.

4. In the Description field, type a short description of the charge.

5. Click the Item sales tax group arrow and select the sales tax group.

6. Click the Posting tab.

7. Setup the debit/credit fields as follows:

| Debit | Type | Ledger Account |

| Posting | Specify | |

| Account | Specify | |

| Credit | Type | Ledger Account |

| Posting | Specify | |

| Account | Specify |

Charges Codes for Purchases

For purchases you can configure charges in 4 different ways. Repeat the following basic steps for all of the 4 different configurations then we’ll see how to setup the Posting fastTab:

1. Open Accounts payable > Setup > Charges > Charges code.

2. Click New to add a new code.

3. In the Charges code field, type a unique identifier for this charge.

4. In the Description field, type a short description of the charge.

5. Click the Item sales tax group arrow and select the sales tax group.

6. Click the Posting tab.

2. Click New to add a new code.

3. In the Charges code field, type a unique identifier for this charge.

4. In the Description field, type a short description of the charge.

5. Click the Item sales tax group arrow and select the sales tax group.

6. Click the Posting tab.

Here are the 4 different configurations for the posting fastTab

1. Paying to Creditor – Billing to Item

Setup the debit/credit fields as follows:

| Debit | Type | Item |

| Posting | N/A | |

| Account | N/A | |

| Credit | Type | Customer/Vendor |

| Posting | N/A | |

| Account | N/A |

2. Paying Internally – Billing to Item

Setup the debit/credit fields as follows:

| Debit | Type | Item |

| Posting | N/A | |

| Account | N/A | |

| Credit | Type | Ledger Account |

| Posting | Specify | |

| Account | Specify |

3. Paying to Creditor – Billing Internally

| Debit | Type | Ledger Account |

| Posting | Specify | |

| Account | Specify | |

| Credit | Type | Customer/Vendor |

| Posting | N/A | |

| Account | N/A |

4. Paying Internally – Billing Internally

| Debit | Type | Ledger Account |

| Posting | Specify | |

| Account | Specify | |

| Credit | Type | Ledger Account |

| Posting | Specify | |

| Account | Specify |

No comments:

Post a Comment